It’s unfortunate that climate has become a polarized issue. But facts must be faced and we can only work within the system we find ourselves in. So how do we un-polarize it?

One option would be not to talk about climate so much. Instead focus on a proxy good that can be designed to materially benefit everyone while also functionally addressing greenhouse gas emissions.

Who doesn’t want to do away with the income tax? No need to file on April 15 for the 99% of Americans? For most people that is more than $15,000 in your pocket every year. Could you hope to find a more popular talking point for the campaign trail?

In this short post I put forward a simple tax policy proposal—remove income tax entirely for everyone earning under $550,000 per year and replace the revenue with a tax on the embodied carbon within consumer goods. What’s not to like?

Embodied Carbon

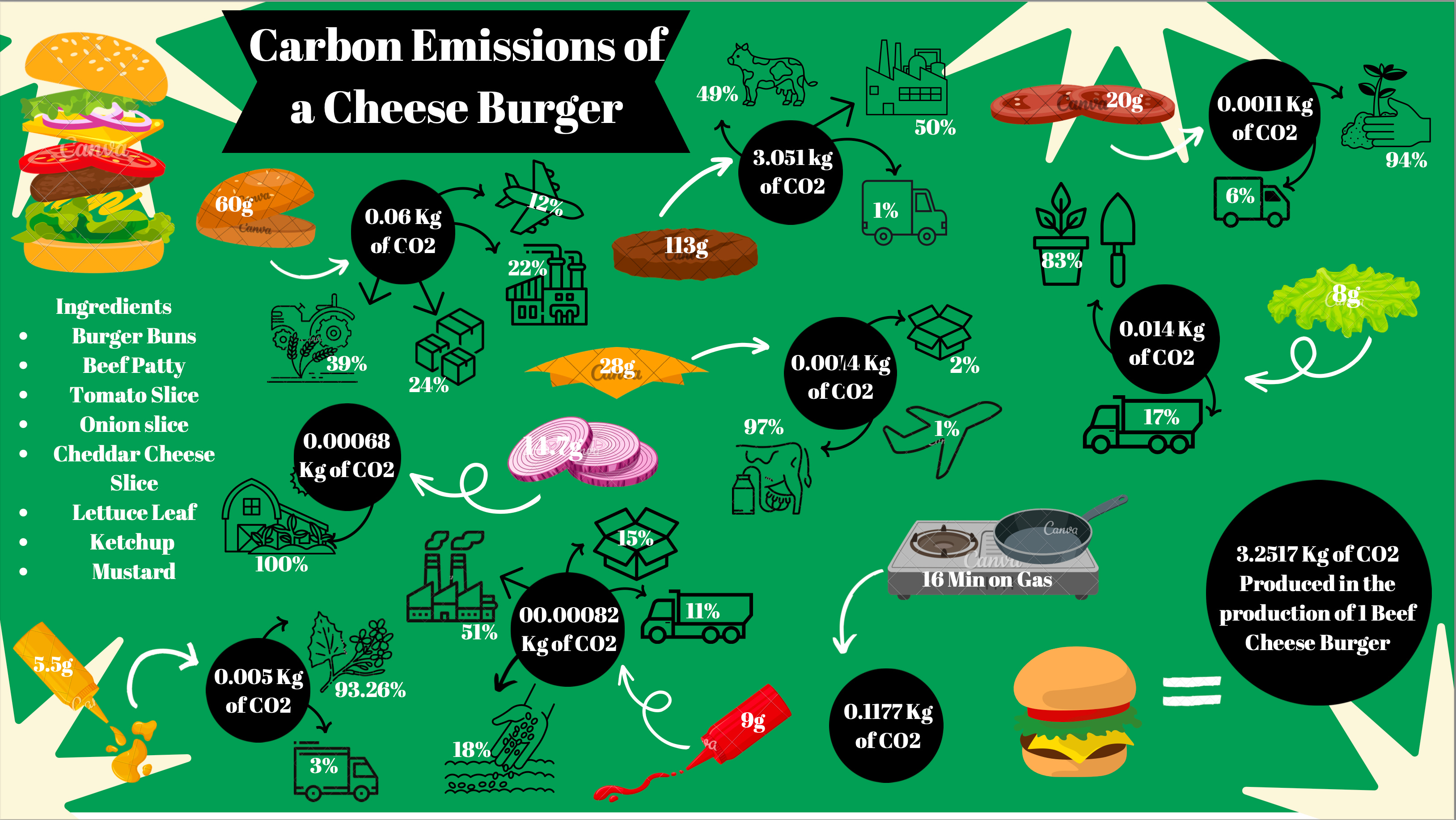

Embodied carbon is the measurement of how much carbon or GHG equivalent was emitted into the atmosphere during the entire value chain that went into the making of that good and delivery of that good to the retail outlet.

Pretty much every product has been studied in terms of the embodied carbon it contains. We know these numbers already. Companies definitely know their own numbers. It’s interesting to note that the weight of a cheeseburger is 210 grams, so the weight of the carbon emitted in its making is 15 times the weight of the actual food item.

Under the proposed new tax system that replaces income tax, every product would come with a embodied carbon tax (ECT) that is in proportion to the embodied carbon in the particular product. California is already implementing a statewide accounting system for this, but we can place an average kgCO2 description on products that are not verified to be lower. Companies who want to showcase the results of their own environmental value chain investment can provide a verified carbon label on their products and reduce the tax for their certified good. Risk of duplication in accounting will be limited by having the tax only apply to end consumer goods, not business-to-business or wholesale transactions.

If you are a savvy consumer (a homo economicus), you will gravitate to the goods with less embodied carbon because on balance they come with a built-in 10% discount. This provides space for what Bill Gates calls the green premium.

Social Cost of Carbon

The Biden Administration recently announced a $190 per ton Social Cost of Carbon (SCC) that is being used by the EPA and other government agencies when making regulatory decisions. We can simply use this SCC as the vehicle for imposing the embodied carbon tax.

The way this would work for the cheeseburger example above is that $190 per ton of carbon would be added to the price of the cheeseburger. ($190 per ton x 0.0032517 tons (3.2517 kg) = $0.62). Sixty-two cents is about 20% of the cost of a cheeseburger these days. The veggie burger option would probably only have a few cents added to it since nearly all of the embodied carbon in a cheeseburger comes from the meat.

As you ponder these questions while in line at the fast food restaurant, you decide are not too worried about the cost of your cheeseburger, because you don’t have to pay income taxes anymore.

Treasury Income

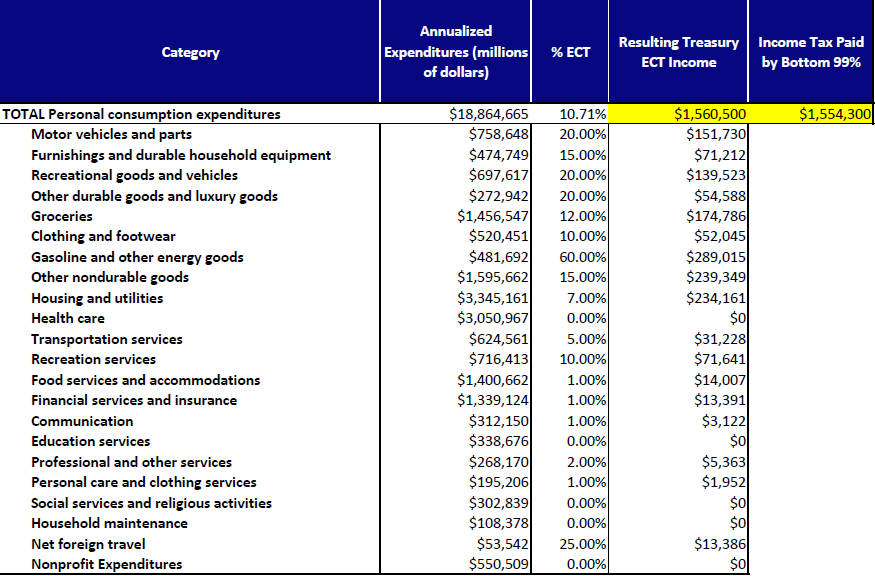

The U.S. government’s expected revenue is $4.71 trillion for FY 2023. The proportion represented by income tax paid by those earning less than $550,000 (the 99%) is about one-third of total tax revenue, or about $1.55 trillion.

Using the Personal Consumption Expenditure (PCE) information from the Bureau of Economic Analysis we can get a quick look at what revenues would be like from the perspective of the U.S. Treasury if we were to implement the new embodied carbon tax system. The below numbers are in millions of U.S. dollars. Yes, Americans spend nearly $19 trillion every year on stuff. Higher percentage ECT is assigned to goods and services with higher embodied carbon. This is shown very crudely below but would be a consequence of the unique carbon content of each good and service. Socially valuable expenses and services like education and healthcare are not taxed even though they may have some embodied carbon content.

Over time consumer behavior would shift to favor items with lower embodied carbon and carbon emissions will come down generally. This would mean that the plan is working, but it also would reduce revenue if left unchecked.

While it was inspired by the EPA’s new rule, in fact the $190 multiplier is arbitrary. As embodied carbon goes down, the multiplier could be raised to ensure the total revenue remains the same. Eventually the tax would shift to being known as a kind of value added tax that would no longer be tied to carbon. It would be applied equally to all goods and services at 10%. The key to maintaining consistent revenue is to keep the rates progressive and high on the income tax due on earning above $550,000. I’d also recommend a wealth tax, but that is for a different post.

This system has the added benefit that it does not require the U.S. to implement carbon tariffs on traded goods, which could present a diplomatic encumbrance and be subject to manipulation by goals of foreign policy. The cost of the carbon is paid for by the end consumer, regardless of its origin, although miles traveled in delivery will certainly be counted in the embodied carbon calculation.

In summary, get rid of all income tax for 99% of people, tailor an embodied carbon sales tax to match or exceed current revenue, and place effective price signals into the market that will naturally create decarbonization through free-market competition to reduce prices on goods and services.